Monitoring and Improving Cash Flow and Cash Controls.

Do you ever feel like you just never seem to have any cash on hand? Is your cash leaving the business as quickly as it comes in? Take a few minutes to get a better understanding of your cash flow and review the controls you have in place over cash.

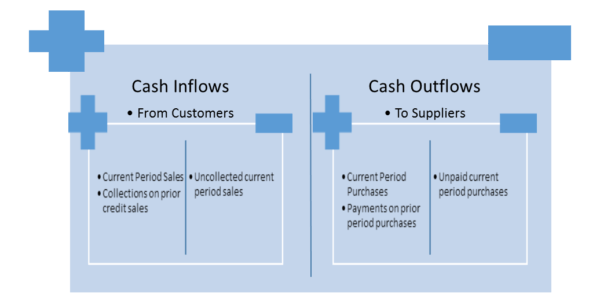

The typical GAAP cash flow statement reconciles cash sources and uses to ultimately show your net cash inflow or outflow for a period of time. To truly gauge the viability of your business, focus on cash flows from operations (for purposes of this diagram we are excluding cash flows from financing and investing activities). To simplify, think of your cash flows visually as follows:

Common other cash flows for investing and financing activities are purchases and/or sales of capital assets, sales of investments/securities, loan or line of credit advances and repayments and stockholder contributions and dividends/distributions.

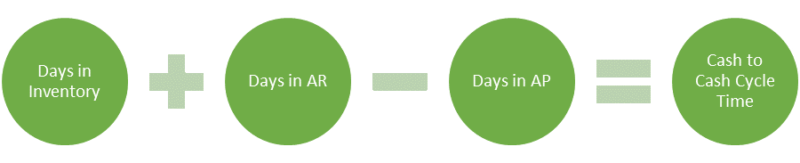

Following is a useful metric to determine your cash-to-cash cycle time, this gauges how quickly your company is paid by customers relative to how quickly it has to pay suppliers. Reducing this cycle time can increase profitability.

For example:

Days in inventory = 30

Days in AR = 60

Days in AP = 30

Cash to Cash Cycle time = 30+60-30= 60 days

Are you finding unexpected uses of cash or are slow collections from customers creating negative sources of cash?

Some common ways to improve cash flows:

- Sell excess inventory

- Reduce overhead

- Increase profitability

- Reduce collection times

Now is also the time to review your controls over cash receipts and disbursements.

Common controls that should be in place in your business include:

- Frequent review of delinquent accounts receivable.

- Compare receipts to customer balances and general ledger postings.

- Reconcile the aging reports to the general ledger regularly.

- Ensure adequate segregation of duties or compensating controls over the custody and recording functions of cash.

- Review manual adjustments to accounts receivable for proper approval.

- Deposit receipts promptly.

- Review manual adjustments to cash accounts regularly.

- Bank reconciliations should be done timely and reviewed by an individual outside of the preparation and custody of cash cycle.

- Bank statement should be received by person other than individual preparing the bank reconciliation and reviewed for alterations and erasures.

- Review of duplicate vendor invoice numbers.

- Ensure proper matching of PO, receiving documentation and invoice prior to payment.

- Review any manual checks written outside of the standard disbursement system.

- The check signer is someone other than an individual preparing or authorizing the check.

- The check signer should review all supporting documentation prior to signing the check.